Summary

The AI impact will vary across sectors, with AI winners likely to possess a competitive advantage and the resources to invest in AI technologies.

Main convictions around Artificial Intelligence (AI)

| 1. AI has the potential to positively impact productivity and GDP growth in the long term, but the impact will not be linear across sectors, especially in the early phases. | 2. The tech sector and US mega caps have outperformed due to AI expectations, leading to extreme market concentration. Investors should reassess tech names’ valuations and identify winners and losers. | 3. Companies that are already heavily investing in AI are more likely to see benefits, but they may also face increased competitive pressure and questionable business cases. |

Key views

We believe that Artificial Intelligence (AI) could have over the long-term a positive impact on productivity and GDP growth. However, the impact will not be linear across sectors, especially in the early phases. Those companies that are already investing heavily in AI technologies are the most likely to see benefits to revenues and/or profitability, but disappointments will happen given increased and new competitive pressure as well as the emergence of questionable business cases in light of the involved costs.

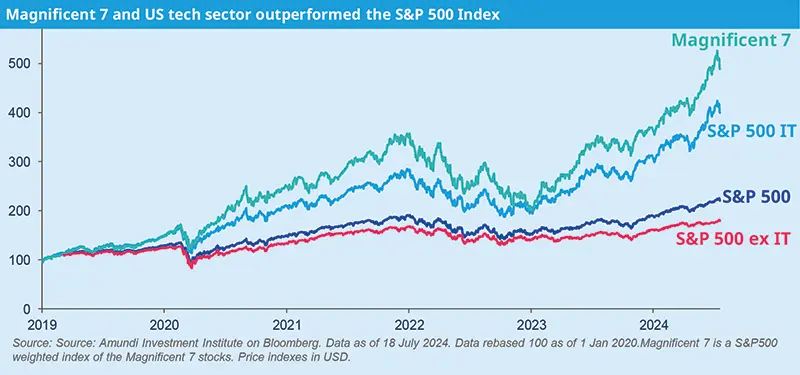

With rising expectations around AI, the tech sector and US mega caps have outperformed strongly in recent times, leading to higher market concentration. In particular, the US tech companies have risen by 300% since the start of 2019, whereas non-tech stocks gained just 79%.1 This poorly discriminated performance has been driven by robust earnings growth in the US Mega Cap, a supportive economic backdrop and the launch of ChatGPT 3.5 (2023) that led to a cycle of investment in AI technologies. Investors may need to consider a potential reset of the tech sector’s valuation levels, and determine the companies which are likely to be the future winners and losers across the market.

To help identify such companies, we use a framework which categorises them into four AI types: tech providers, tech enablers, deployers and disruptors. The AI tech providers (e.g. semiconductor companies) are the early winners that are well-positioned to exploit the robust AI demand, while the AI tech enablers (e.g. hyperscalers/cloud providers, data centres) are heavy investors in Al, purchasing the majority of the leading-edge AI graphics processing units (GPUs).2 The AI deployers are those businesses that are already leveraging AI to transform their businesses whereas the AI disruptors are new entrants that will disrupt business processes by using AI technologies to achieve greater scalability.

There will be winners and losers in most industries. However, to be a “winner” a company needs not only to be an early-mover in terms of investing in AI, but also possess a proprietary data advantage, an existing competitive edge based on market position and an ability to innovate successfully. Otherwise, any advantages from using AI technologies could be competed away. In our view, the future winners are most likely to be found among the existing competitively-advantaged companies.

We highlight those industries which may see a meaningful impact from AI beyond the tech enablers and related suppliers, such as the software and services, media and entertainment, commercial and professional services and industrials sectors. Our attention is also focused on areas where AI will have a significant role, but the long-term outcome for growth and margins is uncertain. These include the financials, as this sector is an early-adopter, and health care, given it is already investing notable capital in AI.

To finish, we highlight findings from interviews conducted by Amundi Technology with senior financial services executives over the last six months. For example, GenAI was discussed in almost every conversation, unlike in the past when it was rarely mentioned. In addition, the rapid pace of change those businesses are now facing was emphasised. Any time frame for optimising business plans that stretches beyond six months is considered by these executives as being long-term. This pace has ensured that the best-in-class companies are seeking partners to help them navigate their challenges. In particular, attention was drawn to the importance of using AI to unlock the power of proprietary data, given that some of the AI technologies will become commoditised. AI can do general things very well, but may struggle when it comes to specifics.

Discover more