Summary

Highlights

- We expect slowing inflation and a weak recovery in Europe in 2025

- The ECB is most likely to cut rates further over the upcoming meeting.

- The economic backdrop is supportive for global cross-asset investing.

In this edition

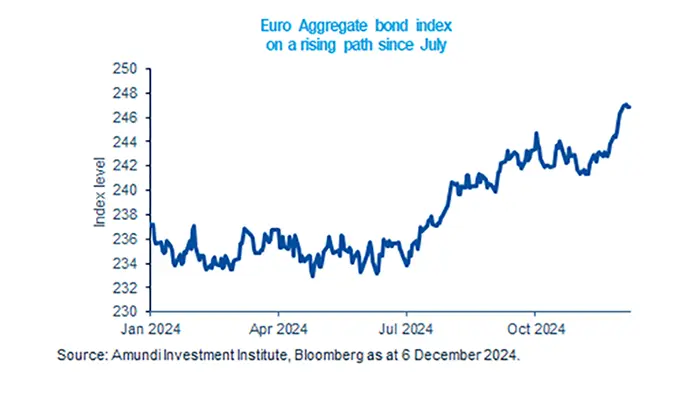

The Euro Aggregate bond index has been on a rising path in the second half of the year, with a performance of around +5%. The appeal of European bonds remains strong due to slowing inflation and anticipated rate cuts by the ECB. This will also benefit French bonds, which have experienced some volatility in recent days amid political uncertainty which led Prime Minister Michel Barnier to resign. The French debt market is characterised by high liquidity and depth, and all major rating agencies have reaffirmed France's quality rating, with the latest being S&P maintaining its assessment of 'AA-/A-1+' and a stable outlook. The outlook on peripheral bonds also remains stable and does not show any signs of contagion from France, further backing the appeal of European bonds.

Key dates

China CPI and PPI

US CPI (headline and core indices)

ECB interest rate decision, UK GDP MoM and industrial production

Read more