Summary

Highlights

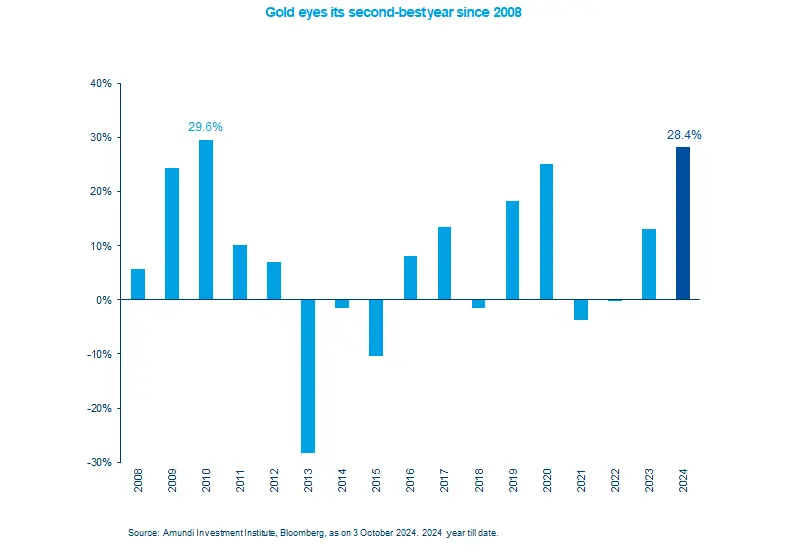

- The yellow metal has delivered strong gains amid monetary easing and rising risks around international conflicts.

- However, any change in market’s rate cut expectations could create near term volatility in gold prices.

- The metal could potentially be used to provide stability to portfolios in times of low economic growth.

In this edition

Prices of the precious metal have risen significantly so far this year (28.4%), well-ahead of the S&P 500 (around 20%). The move has been so strong that the precious metal appears to be heading for its second-best annual performance since the great financial crisis. There are multiple factors behind the rally that will likely continue to support prices in the near term -interest rate cuts by the Fed that raise the appeal of the non-yielding metal, heightened geopolitical tensions, such as the one in the Middle East, and purchases by central banks.

In addition, high fiscal deficits and government debt may boost the long term appeal of gold. Excessive spending (not backed by income) by governments could pressurise fiat currencies such as dollar and in the process erode its purchasing power. This, along with any potential worries on inflation, could potentially increase gold’s appeal as a store of value.

Key dates

FOMC minutes, RBI monetary policy

US CPI and labour markets

German CPI, UK GPD, Bank of Korea policy

Read more