Summary

Highlights

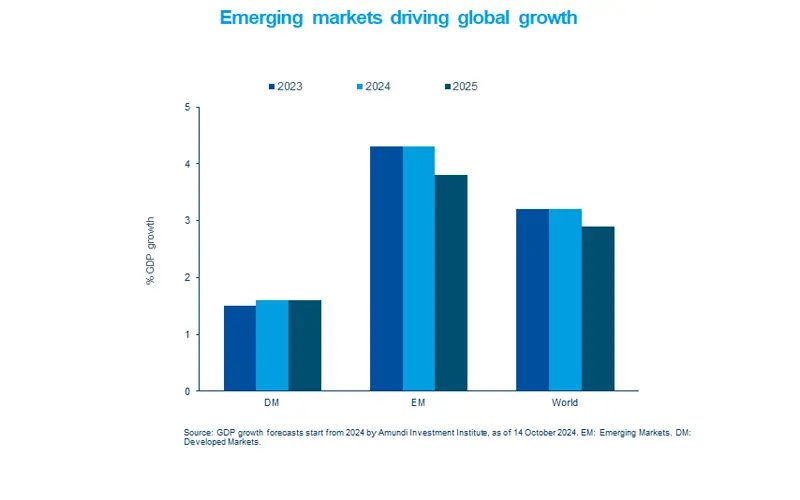

- Emerging markets are likely to drive global growth in the long term, led by favourable demographics and demand.

- Regions such as Asia are characterised by divergences - this requires a good understanding of country dynamics.

- Monetary easing by the Fed and subsiding inflation in EM should be further supportive of the asset class.

In this edition

Emerging markets could drive global economic growth, well ahead of the developed world. With a growing middle class, improving standards of living, strong consumption and potential for exports, Asia stands out. But there are many divergences across EM and countries such as India and Indonesia are attractive from a structural long-term perspective. In addition, China has indicated more recently a clear intention to provide policy support. But we await more specific details on fiscal policy. On monetary policy, inflation in most EM is under control and many prudent central banks have started easing policy depending on their country-specific needs. We could see some near term volatility stemming from US elections and geopolitics, but overall the EM world will continue to provide attractive ideas for long-term returns.

Key dates

Bank of Canada policy, Fed beige book

EZ and Japan PMIs, South Korea GDP

ECB CPI expectations, US durable goods

Read more