Summary

Highlights

-

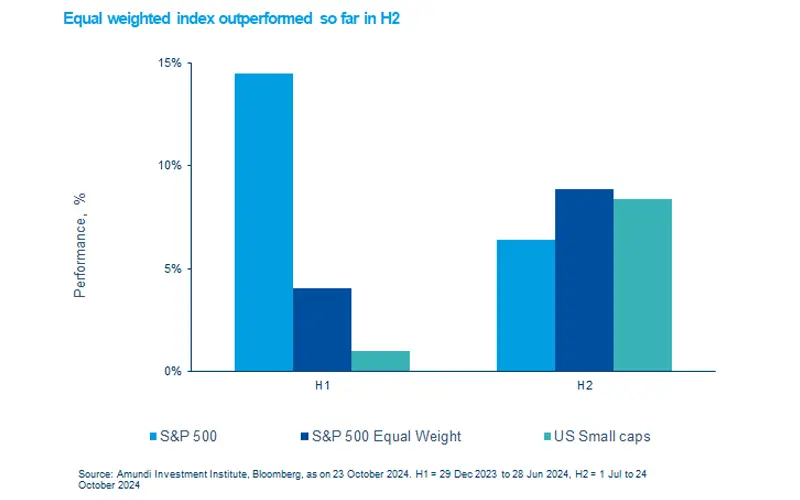

The S&P equal weighted index has outperformed the market-cap weighted S&P 500 since June.

-

Market uncertainty is on the rise approaching US elections.

- Global equities will likely benefit from the broadening of the rally and supportive Central Banks.

In this edition

The S&P 500 reached multiple record highs this year, fuelled by optimism about a strong US economy, particularly in the first half, led by the tech magnificent 7 (seven large and influential technology stocks in the S&P 500). Since June, the rally has expanded to include small caps and other sectors, aligning with our view of a rotation driven by earnings growth beyond the Mega Caps, alongside supportive monetary policies from the Federal Reserve.

Most recently, this rotation has also been influenced by market expectations surrounding the outcome of the US elections1. This theme is likely to introduce further uncertainty in the coming weeks and lead to additional market rotations.

A combination of both a market-weight and equal-weight approach can help to seek a balance in this phase.

1. See more on US elections in our recent publication

Key dates

EZ GDP, US GDP and ADP employment

EZ CPI, BoJ target rate, US personal income

China Caixin manuf. PMI, US employment and ISM manuf.

Read more