Summary

Highlights

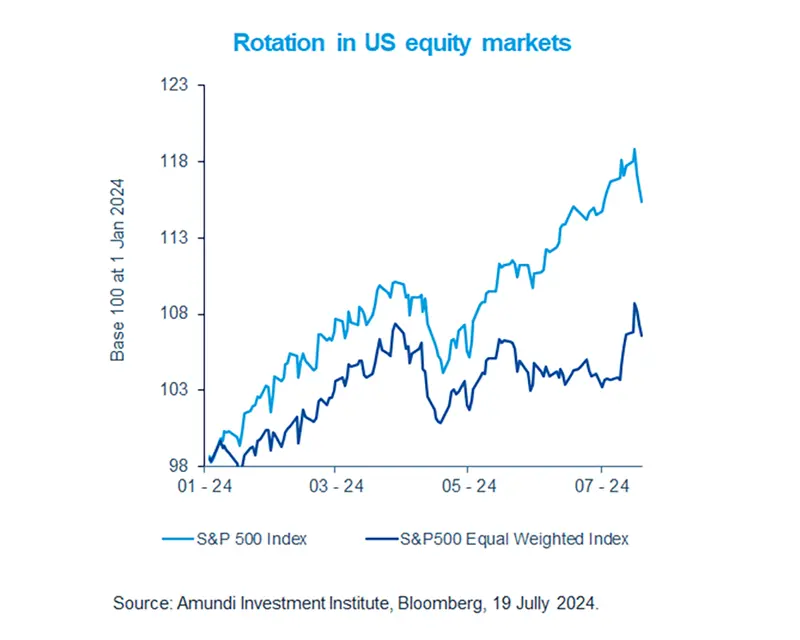

- Mega-cap companies in the US have had a strong performance this year, further increasing market concentration.

- Now, we are witnessing a broadening of the rally towards the equally weighted markets and smaller companies.

- ECB kept rates unchanged in Europe. More rate cuts expected later, potentially benefiting small caps.

In this edition

The S&P 500, index which is highly concentrated around few mega caps, outperformed most other market in the US. This was led by enthusiasm around artificial intelligence and resilient economic activity. But soon after the June inflation was released, markets raised their expectations of Fed rate cuts. This caused some profit taking in the mega caps, benefitting the small caps and the S&P 500 equal weighted (where all 500 stocks have an equal weighting).

The continuation of this rotation depends on strength of earnings growth in these companies and economic outlook. Geopolitics is also relevant, as any hint of restriction on chip exports could negatively affect tech stocks. We think investors should now assess market fundamentals, and potentially explore attractively priced names with strong balance sheets.

Key dates

|

22 Jul China prime lending rates |

25 Jul US GDP, South Korea GDP |

26 Jul US PCE, ECB CPI expectations |

Read more